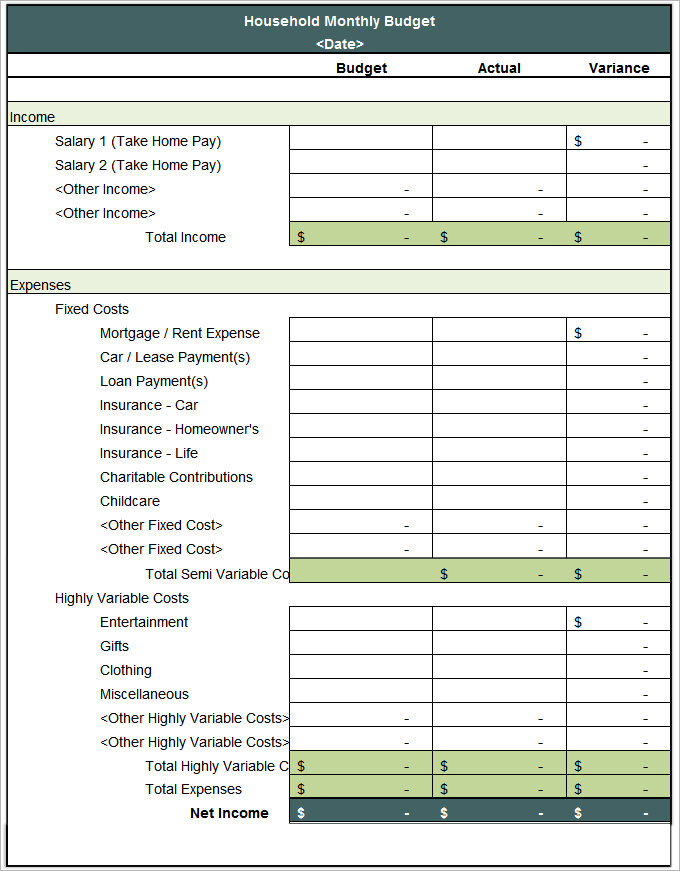

Take note of everyone's monthly earnings. Get clear on how much money is coming in and where your money is going. You'll also have a baseline of your savings, debts, and expenses to see how they change as you begin budgeting.

BUDGETING HOUSEHOLD EXPENSES HOW TO

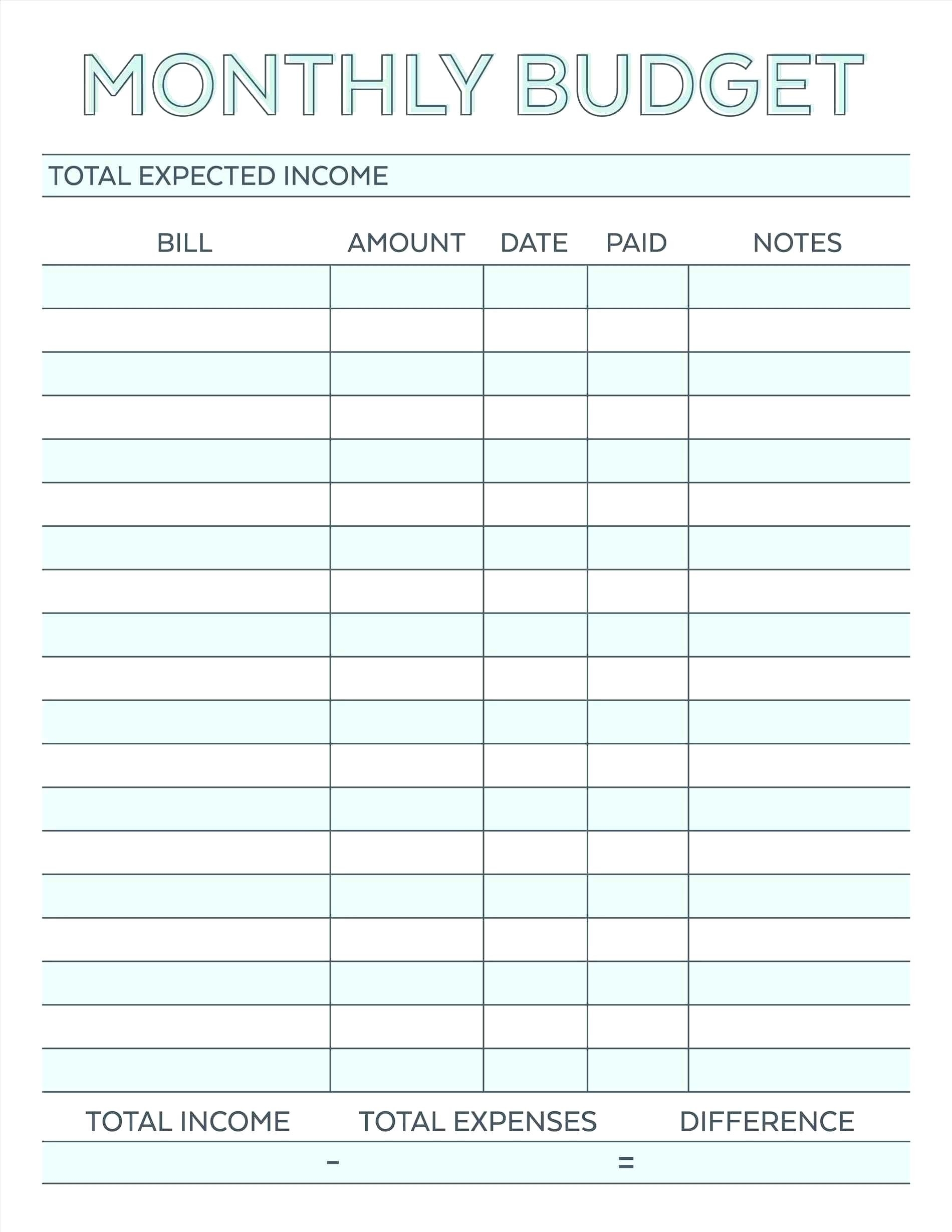

"Decide where you can cut or eliminate specific expenses, and then figure out how to reallocate those dollars to better align with your objectives," Moore advises.Īt the very least, you now have a better understanding of your family's financial situation. You might realise that you're spending twice as much money as you thought you would on groceries by using coupons. Alternatively, you may discover that you are still paying for a membership that you should cancel. Perhaps you weren't aware of how much interest you paid on a particular loan and decided to contact and bargain. You and your family may undoubtedly find a few strategies to improve your finances from here. She claims that figuring out the exact amounts is often an "awakening experience," as many people grossly underestimate their spending. Moore has helped numerous clients navigate this process. After that, log in to each of your financial accounts and list the real amounts you had estimated. To avoid becoming overwhelmed, take a slight pause. "All you want is a general overview," Moore says, adding that the exercise should take approximately 15 minutes. Remember that you're only guessing at this stage. According to Moore, you can record these charges individually or as a group. Break down your monthly spending into how much you spend on groceries, gas, clothing, and other items. Finally, make a budget for the rest of your expenses. Then go over your debts: What is the total amount owed on each debt, including monthly payments and interest? Repeat the process for regular monthly expenses such as your water bill. Make a list of how much money you have in savings. She suggests that everyone's money be audited first. "Creating transparency about where you are currently is the first step," Moore explains.

(This may be you and your partner, your grown children, or your parents.) Scheduling holds you accountable and ensures that everyone is calm and focused on the task. Let us now understand how can one create a family budget and what are some important points one needs to keep in mind while creating a family budget-Īccording to Moore, set out time on your calendar for you and the other adults in your household to begin budgeting. Calculating how much money you'll need for daily necessities like food, housing, utilities such as gas, electricity, phone, water, transportation, and medical services will help you budget for unforeseen expenses and emergencies.Īlso Read: How to Plan and Manage Your Personal Finance?.

She claims that many people spend their money without thinking about it, but you get to pick how to use that money to work for you. For example, you might set aside specific cash amounts or percentages of your combined monthly income for various expenses such as food and saving, investing, and debt repayment.Īngela Moore, a certified financial planner in Orlando, says, "Your budget is simply a tool for empowering yourself". A family budget is a plan for your household's incoming and outgoing funds over a specific time period, such as a month or year. Understanding what a family budget is and the fundamentals of the family budget, the family budget, is a plan for your household's incoming and outgoing funds over a specific time period, such as a month or year.

0 kommentar(er)

0 kommentar(er)